Awareness of cryptocurrencies is constantly increasing, and Bankrate LLC has decided to conduct a survey focusing on the investment interests of the US population. The New York-based financial services company was founded in 1976 by an investor named Robert Heady. Yesterday we received the results of this May survey (25th – 30th), while we learned quite interesting information.

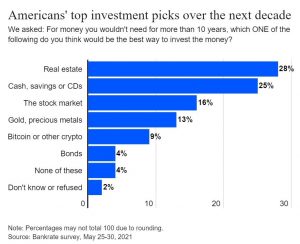

As we can see in the graph above, the first and probably most important question was about investments, or where investors would invest money if they did not need it for the next 10 years. We can see from the graph that US citizens trust investment in real estate the most (28% of respondents), while up to 25% of respondents said that they would keep money in physical form (cash) or savings. Furthermore, 16% of respondents would invest in the stock market, 13% would invest in gold or precious metals, and Bitcoin and other cryptocurrencies would end up in fifth place, where 9% would invest.

One of the questions was also whether inflation would change their investment decisions in any way. 58% of respondents answered that inflation would not change their decisions in any way, while 20% of respondents would invest more aggressively.