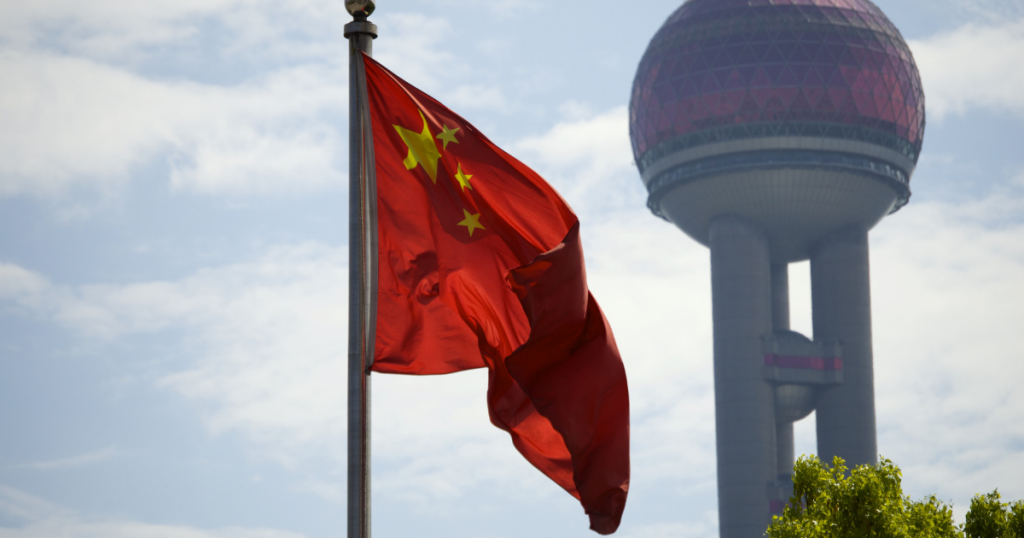

As you probably know, a few days ago, China decided to ban banks and other institutions from offering cryptocurrency-related services to people. In a way, this country has always been against cryptocurrencies, as evidenced by several bans in previous years, such as the ban on ICOs or the closure of crypto exchanges. However, individuals as such can hold cryptocurrencies. This time, however, it is possible that their decision will have adverse consequences for the country.

However, what was very positive was the market reaction to these reports. With the price, it did almost nothing that day, which surprised many of us, and, conversely, China was criticized directly for this decision, including by the WEC. It was all the more surprising that there were huge power outages in Sichuan Province on Monday, causing up to a 20% loss in Bitcoin’s Hash rate, and we saw a really small decline in price that day compared to what we were used to in previous years. Cryptocurrencies are still very volatile, but such news as we could see on Monday and Tuesday, would cause a much larger drop for example in 2017.

According to Reuters, China said in a statement that recent changes in cryptocurrencies have seriously undermined the security of property for ordinary people, as well as economic order. However, the WEF also commented on the whole situation, which is a big positive for the crypto world as such. The World Economic Forum (WEF) claims that China has inadvertently slowed down its business innovation due to a new ban on cryptocurrencies.

“We fully expect bitcoin’s price to remain volatile, as it tends to be hyper-responsive to even the hint of regulation. That being said, China’s move doesn’t necessarily presage similar crackdowns in other jurisdictions, and this move is likely to affect Chinese business innovation, which has already been slow because of the concern about regulatory action, more than consumer activity.”