Yield farming, occasionally also referred to as liquidity mining, is one of the latest hype trains within the DeFi space. The core idea of yield farming is generating passive income with your existing crypto. Essentially, what you have to do is lend out the crypto you own, and earn increased returns in exchange. Yield farming is already revolutionizing the way crypto traders operate, by replacing the strategy of ‘HODL’ing on to one’s digital assets instead of putting them to use.

What is Crypto Yield Farming? Source

What is Crypto Yield Farming? Source

What is Yield farming?

Simply put, yield farming involves borrowing cryptocurrency through the Ethereum network. When loans are made through banks using fiat money, the amount borrowed is repaid with interest. In yield farming, the concept is the same: cryptocurrency that would otherwise sit on an exchange or in a wallet is lent out via DeFi protocols (or locked into smart contracts, in Ethereum terminology) in order to earn a return.

Yield farming is typically done using ERC-20 tokens on Ethereum, with the rewards being in the form of an ERC-20 token. Although this may change in the future, almost all current yield farming transactions take place in the Ethereum ecosystem.

History

The sudden hype surrounding yield farming is owed almost entirely to the launch of the COMP token – the governance token of the Compound Finance exchange. Governance tokens – in case you were unaware – allow holders to vote in the governance decisions of a particular exchange platform, or suggest a certain change.

Compound, an Ethereum-based credit market, developed a functional decentralized blockchain system by distributing the COMP tokens with liquidity incentives; users were given the opportunity to earn rewards by adding liquidity to the various liquidity pools (more on that later) on the Compound platform and ‘farm’ COMP.

Compound finance logo Source

Compound finance logo Source

Compound Exchange started distributing the COMP tokens to the protocol’s users on June 15, 2020. As demands for the token rose high and Compound rose into a leading position within the DeFi space, the platform also helped bring the concept of yield farming to the mainstream. Since then, quite a few other DeFi protocols have integrated the yield farming strategy with varied economic incentives to convince users to lend out their cryptocurrency.

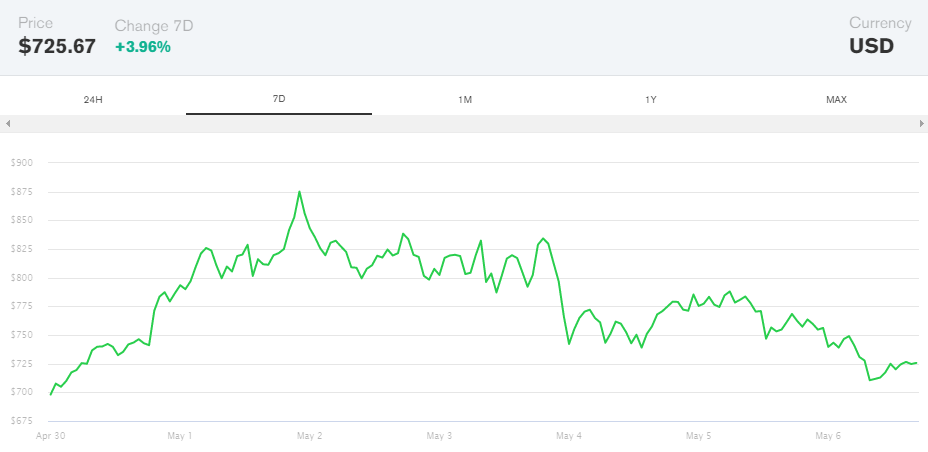

COMP token chart from April 30th – May 7th Source

COMP token chart from April 30th – May 7th Source

How does Yield Farming actually work?

As mentioned before, in yield farming, a group of users put their own crypto assets into liquidity pools and generate yields. These users are known as the LPs, or the liquidity providers.

Yield farming is closely related to a model known as automated market makers (AMMs). LPs put money into liquidity pools. This pool supports a market where users can lend, borrow or exchange tokens. Fees are charged for the use of these platforms, which are then paid to liquidity providers according to their share of the liquidity pool. This is the cornerstone of the operation of AMMs.

Implementations can vary widely – not to mention new technology. No doubt we will see new approaches that will improve current implementations.

In addition to fees, another incentive to add money to the liquidity pool could be the distribution of new tokens. For example, it may not be possible to buy tokens on the open market, only in small quantities. On the other hand, it can be accumulated by providing liquidity to a particular pool.

Who are LPs – liquidity providers

Yield farming is not possible without LPs putting their funds in liquidity pools. The collection of orders in such trading networks facilitates cryptocurrency trading by creating a marketplace. In business, they are often known as market makers because they provide what buyers and sellers want to trade.

What is a liquidity pool and how do LPs benefit from farming?

Now you might be wondering what a liquidity pool is. Well, they are sort of like marketplaces where you can borrow or lend out digital assets, and trade out one crypto for another. Liquidity pools are, in fact, smart contracts on a DeFi exchange platform that are programmed to hold funds. When a liquidity provider deposits their crypto into one of the liquidity pools, the code in the smart contracts makes sure they earn rewards in return. Usually the yields are a share of the trading fees the DeFi exchange hosting a liquidity pool charges.

All distribution rules will depend on a single implementation of the protocol. The bottom line is that LPs receive profits based on the amount of liquidity they are providing to the pool.

In LuaSwap, LUA tokens will be given to the Liquidity Providers (LPs) to encourage them to continue with the protocol. Holding LUA tokens, LPs earns a share in the governance of the protocol. They can decide which chains to implement LuaSwap, how much LUA to distribute to the LPs in the new chain, which new token projects LuaSwap will support, and more.

According to TomoChain, token distribution can have the greatest impact on strengthening the network of user communities and contributors. It must be carefully designed to prevent short-term opportunistic yield farmers who sell immediately and leave the protocol as soon as the farming yield drops. Token distribution through yield farming could support a strategy for pools where the majority of the pool liquidity will be in LuaSwap in the long run.

What is the APY Method?

APY, or annual percentage yield, is an annualized method that predicts the amount of returns one could get over a year. The APY is the rate of return earned on an investment when you account for the effect of compounding interest, presuming the money remains deposited for one year.

The formula for calculating APY is:

APY= (1 + r/n )n – 1

Where r = period rate, and n = number of compounding periods.

Now, it’s important to remember that the calculations made through the APY method are only predictions, and the anticipated returns are not guaranteed. The volatility in the prices of cryptocurrencies can affect yearly returns, since the price of a particular token can fall at any given moment. As of right now, crypto yield farming is also an uncertain and competitive space, and therefore any estimations can always be proven wrong.

Yield farming platforms and protocols

Aave

Aave is a decentralized protocol to earn interest on deposits and borrow assets. The protocol’s algorithm adjusts interest rates based on current market conditions. Lenders get “aTokens” in return for their funds. These tokens immediately start earning and compounding interest upon depositing. Aave also allows other more advanced functionality, such as flash loans.

Aave is a decentralized protocol to earn interest on deposits and borrow assets Source

Aave is a decentralized protocol to earn interest on deposits and borrow assets Source

Uniswap

Uniswap is a decentralized exchange protocol (DEX) for trustless token swaps. Liquidity providers deposit an equivalent value of two tokens in order to create a market. Traders can then trade against that liquidity pool. In return for providing liquidity, liquidity providers earn fees from the transactions that occur in their pool.

Uniswap is one of the most popular platforms for trustless token swaps due to its frictionless nature. This can be useful for productivity farming strategies.

Uniswap is a decentralized exchange protocol (DEX) for trustless token swaps Source

Uniswap is a decentralized exchange protocol (DEX) for trustless token swaps Source

Curve Finance

Curve Finance is a decentralized exchange protocol designed for extremely efficient stablecoin swaps. Unlike other similar protocols like Uniswap, Curve allows users to perform high-value stablecoin swaps with relatively low slippage.

Curve Finance is a decentralized exchange protocol designed for extremely efficient stablecoin swaps Source

Curve Finance is a decentralized exchange protocol designed for extremely efficient stablecoin swaps Source

Yearn.finance

Yearn.finance is a decentralized ecosystem of aggregators that utilize lending services like Aave, Compound, and others. It aims to optimize token lending by finding the most profitable loan services algorithmically. Funds are converted to yTokens upon deposit to be rebalanced periodically to maximize profits.

Yearn.finance is for those who want a protocol that automatically chooses the strategies that are best for them.

Yearn.finance is a decentralized ecosystem of aggregators that utilize lending services Source

Yearn.finance is a decentralized ecosystem of aggregators that utilize lending services Source

Luaswap.org

LuaSwap is an automated market maker for token swaps, and cross-chain farming protocol to earn LUA tokens by TomoChain. Inspired by AMM-based swap protocols such as Uniswap and SushiSwap, Luaswap allows liquidity providers of certain pools on the LUA token to farm Uniswap.

With the goal of supporting smaller pools and not competing for liquidity with top tokens, LuaSwap will provide farmers with new opportunities.

LuaSwap is an automated market maker for token swaps, and cross-chain farming protocol to earn LUA tokens by TomoChain Source

LuaSwap is an automated market maker for token swaps, and cross-chain farming protocol to earn LUA tokens by TomoChain Source

QuickSwap

QuickSwap is a permissionless decentralized exchange (DEX) based on Ethereum, powered by Matic Network’s Layer 2 scalability infrastructure. For more information about this project and also how the platform works, see our article in the V.I.P. section HERE.

PancakeSwap

PancakeSwap is a decentralized exchange built on the Binance Smart Chain. When liquidity providers deposit their crypto into one of the pools, they receive liquidity provider/LP tokens in return. For instance, if you added BETH (Binance ETH) and ETH to the pool, you’ll get BETH-ETH LP tokens in exchange. You can use these LP tokens to reclaim your deposit, as well as a portion of the trading fees.

PancakeSwap also gives you the opportunity to farm its native governance token, CAKE. Some of the liquidity pools on PancakeSwap that provide the highest APY at the moment are:

- DAI-BNB (APY 13731.33% yearly)

- YFII-BNB (APY 1290.59% yearly)

- BCH-BNB (APY 563.36% yearly)

- XTZ-BNB (547.60% yearly)

PancakeSwap, the best decentralized exchange on the Binance Smart Chain Source

PancakeSwap, the best decentralized exchange on the Binance Smart Chain Source