Not only is Bitcoin the first cryptocurrency, but it’s also the best known of the more than 10,000 cryptocurrencies in existence today. Financial media eagerly covers each new dramatic high and stomach churning decline, making Bitcoin an inescapable part of the landscape.

Bitcoin is a new currency that was created in 2009 by an unknown person using the alias Satoshi Nakamoto. Transactions are made with no middle men – meaning, no banks! Bitcoin can be used to book hotels on Expedia, shop for furniture on Overstock and buy Xbox games. But much of the hype is about getting rich by trading it. The price of bitcoin skyrocketed into the thousands in 2017, today we are above 40 000 USD.

What Is Bitcoin?

Bitcoin is a decentralized digital currency that you can buy, sell and exchange directly, without an intermediary like a bank. Bitcoin’s creator, Satoshi Nakamoto, originally described the need for “an electronic payment system based on cryptographic proof instead of trust.”

Each and every Bitcoin transaction that’s ever been made exists on a public ledger accessible to everyone, making transactions hard to reverse and difficult to fake. That’s by design: Core to their decentralized nature, Bitcoins aren’t backed by the government or any issuing institution, and there’s nothing to guarantee their value besides the proof baked in the heart of the system.

“The reason why it’s worth money is simply because we, as people, decided it has value—same as gold,” says Anton Mozgovoy, co-founder & CEO of digital financial service company Holyheld.

Since its public launch in 2009, Bitcoin’s value has increased dramatically. Although it once sold for less than $150 per coin, in recent months its value has ranged from $45,000-$64,000, but now the value of a single Bitcoin has fallen below $43,000. Bitcoin reached its all-time high on April 14, 2021 at $64,854. With its supply limited to 21 million coins, many expect its price to only rise over time, especially as more large institutional investors begin to view it as a sort of digital gold to hedge against market volatility and inflation.

How Does Bitcoin Work?

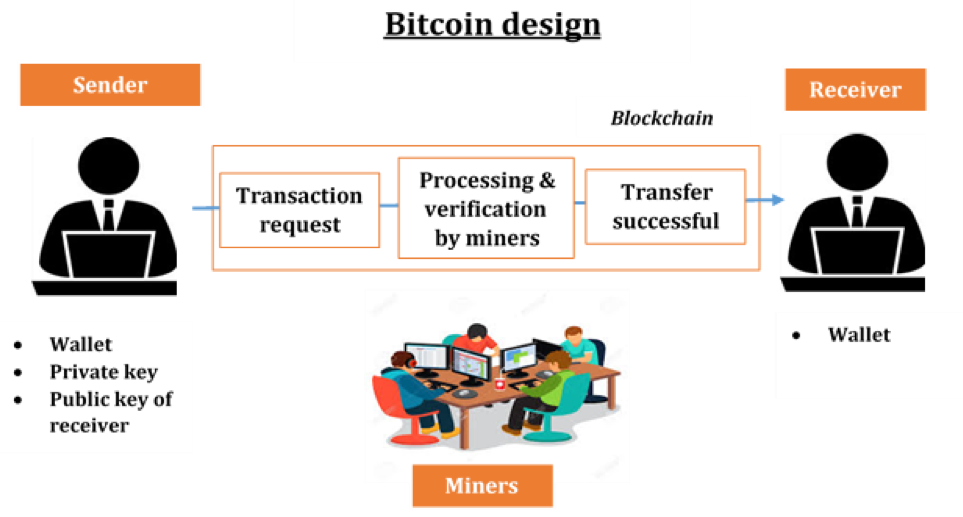

Bitcoin is built on a distributed digital record called a blockchain. As the name implies, blockchain is a linked body of data, made up of units called blocks that contain information about each and every transaction, including date and time, total value, buyer and seller, and a unique identifying code for each exchange. Entries are strung together in chronological order, creating a digital chain of blocks.

“Once a block is added to the blockchain, it becomes accessible to anyone who wishes to view it, acting as a public ledger of cryptocurrency transactions,” says Stacey Harris, consultant for Pelicoin, a network of cryptocurrency ATMs.

Blockchain is decentralized, which means it’s not controlled by any one organization.

Blockchain is decentralized, which means it’s not controlled by any one organization. “It’s like a Google Doc that anyone can work on,” says Buchi Okoro, CEO and co-founder of African cryptocurrency exchange Quidax. “Nobody owns it, but anyone who has a link can contribute to it. And as different people update it, your copy also gets updated.”

While the idea that anyone can edit the blockchain might sound risky, it’s actually what makes Bitcoin trustworthy and secure. In order for a transaction block to be added to the Bitcoin blockchain, it must be verified by the majority of all Bitcoin holders, and the unique codes used to recognize users’ wallets and transactions must conform to the right encryption pattern.

These codes are long, random numbers, making them incredibly difficult to fraudulently produce. In fact, a fraudster guessing the key code to your Bitcoin wallet has roughly the same odds as someone winning a Powerball lottery nine times in a row, according to Bryan Lotti of Crypto Aquarium. This level of statistical randomness blockchain verification codes, which are needed for every transaction, greatly reduces the risk anyone can make fraudulent Bitcoin transactions.

What is Bitcoin used for?

At its most basic level, Bitcoin is useful for transacting value outside of the traditional financial system. People use Bitcoin to, for example, make international payments that are settled faster, more securely, and at lower transactional fees than through legacy settlement methods such as the SWIFT or ACH networks.

In the early years, when network adoption was sparse, Bitcoin could be used to settle even small-value transactions. And do so competitively with payment networks like Visa and Mastercard (which, in fact, settle transactions long after point of sale). However, as Bitcoin became more widely used, scaling issues made it less competitive as a medium of exchange for small-value items. In short, it became prohibitively expensive to settle small-value transactions due to limited throughput on the ledger and the lack of availabily of second-layer solutions. This supported the narrative that Bitcoin’s primary value is less as a payment network and more as alternative to gold, or ‘digital gold.’ Here, the argument is that Bitcoin derives value from a combination of the technological breakthroughs it integrates, its capped supply with ‘built-into-the-code’ monetary policy, and its powerful network effects.

Another popular narrative is that Bitcoin supports economic freedom. It is said to do this by providing, on an opt-in basis, an alternative form of money that integrates strong protection against monetary confiscation, censorship, and devaluation through uncapped inflation. Note that this narrative is not mutually exclusive from the ‘digital gold’ narrative.

Bitcoin Wallets: How to Store Your Bitcoins

So, you’ve got this digital currency. You can’t really chuck it in your pocket. Let’s go through some useful definitions before we jump into storing cryptos:

- Exchange platform: where you trade money for cryptocurrencies such as Bitcoin, Ethereum, or Litecoin. You can also trade one cryptocurrency for another.

- Wallet platform: essentially a bank account where your cryptocurrencies are kept.

- Hard wallet: an “offline” wallet that is not linked to a network.

- Public Cryptographic Key: your account number. Similar to how someone would send money to your bank account via your account number, your public cryptographic key is the information you give to someone to receive cryptos.

- Private Cryptographic Key: the key that allows you to spend your Bitcoins and other cryptocurrencies. You guard this with your life. If someone has access to it, they can transfer (steal!) your bitcoins.

Now that we’ve got that out of the way, we can discuss Bitcoin wallet better.

Security is number 1 priority

When you hear of bitcoins being hacked, you’re probably hearing about an “exchange platform” being hacked. Since Bitcoin’s blockchain structure makes it EXTREMELY difficult to hack (borderline impossible), it is considered very secure.

Exchanges, however, are a different story. Perhaps the most notable hack was the Tokyo-based MtGox hack in 2014, where 850,000 bitcoins with a value of over $350 million suddenly disappeared from the platform. This doesn’t mean that Bitcoin itself was hacked; it just means that the exchange platform was hacked. Imagine a bank in Iowa is robbed: the USD didn’t get robbed, the bank did.

Industries surrounding Bitcoin are new and not without their kinks. Bitcoin advocate and esteemed venture capitalist Marc Andreessen stated, “MtGox had to die for Bitcoin to thrive. Its former role from early Bitcoin days has been supplanted by better, stronger entities.”

Even though most wallet platforms are considered extremely secure, the prospect of hackers makes many users paranoid. These days, many bitcoin exchange have received huge investments from venture capitalists. They’re also now more heavily regulated, especially those based out of the United States.

That brings us to hard wallets. A hard wallet is essentially a USB that allows users to store their cryptographic keys offline and off of exchanges. Your cryptographic key only lives on your hard wallet and is impossible to hack (unless someone physically steals your hard wallet).

Why use Bitcoin?

Bitcoin is often hailed as the future of the monetary world for a variety of reasons.

- It’s decentralized and brings power back to the people. Launched just a year after the 2008 financial crises, Bitcoin has attracted many people who see the current financial system as unsustainable. This factor has won the hearts of those who view politicians and government with suspicion. It’s no surprise there is a huge community of ideologists actively building, buying, and working in the cryptocurrency world.

- Freedom. The concept that one could carry millions or billions of dollars in Bitcoin across borders, pay for anything at any time, and not have to wait on extended bank delays is a major selling point.

- Security. Bitcoin payments don’t necessarily need to be tied to one’s personal information. Since personal information is left out of the transactions, users aren’t as exposed to threats such as identity theft. Bitcoin can also be backed up and encrypted to ensure the security of your money.

- Low Transaction Fees. Banks and companies like PayPal charge to send and receive money. Bitcoin replaces the 2.5% “transaction fee” with one that’s only a fraction of that.

The Immutable Ledger. Bitcoin’s blockchain public ledger is objective. People trust it to be fair because it is based on pure mathematics, rather than the human error and corruption of questionable politicians.

Bitcoin’s basic features

-

- Decentralized: nobody controls or owns the Bitcoin network, and there is no CEO. Instead, the network consists of willing participants who agree to the rules of a protocol (which takes the form of an open-source software client). Changes to the protocol must be made by the consensus of its users and there is a wide array of contributing voices including ‘nodes,’ end users, developers, ‘miners,’ and adjacent industry participants like exchanges, wallet providers, and custodians. This makes Bitcoin a quasi-political system. Of the thousands of cryptocurrencies in existence, Bitcoin is arguably the most decentralized, an attribute that is considered to strengthen its position as pristine collateral for the global economy.

- Distributed: all Bitcoin transactions are recorded on a public ledger that has come to be known as the ‘blockchain.’ The network relies on people voluntarily storing copies of the ledger and running the Bitcoin protocol software. These ‘nodes’ contribute to the correct propagation of transactions across the network by following the rules of the protocol as defined by the software client. There are currently more than 80,000 nodes distributed globally, making it next to impossible for the network to suffer downtime or lost information

- Transparent: the addition of new transactions to the blockchain ledger and the state of the Bitcoin network at any given time (in other words, the ‘truth’ of who owns how much bitcoin) is arrived upon by consensus and in a transparent manner according to the rules of the protocol.

Bitcoin‘s Advantages

- Peer-to-peer: although nodes store and propagate the state of the network (the ‘truth’), payments effectively go directly from one person or business to another.This means there’s no need for any ‘trusted third party’ to act as an intermediary.

- Permissionless: anyone can use Bitcoin, there are no gatekeepers, and there is no need to create a ‘Bitcoin account.’ Any and all transactions that follow the rules of the protocol will be confirmed by the network along the defined consensus mechanisms.

- Pseudo-anonymous. identity information isn’t inherently tied to Bitcoin transactions. Instead, transactions are tied to addresses that take the form of randomly generated alphanumeric strings.

- Censorship resistant: since all Bitcoin transactions that follow the rules of the protocol are valid, since transactions are pseudo-anonymous, and since users themselves possess the ‘key’ to their bitcoin holdings, it is difficult for authorities to ban individuals from using it or to seize their assets. This carries important implications for economic freedom, and may even act as a counter-acting force to authoritarianism globally.

- Public: All Bitcoin transactions are recorded and publicly available for anyone to see. While this virtually eliminates the possibility of fraudently transactions, it also makes it possible to, in some cases, tie by deduction individual identities to specific Bitcoin addresses. A number of efforts to enhance Bitcoin’s privacy are underway, but their integration into the protocol is ultimately subject to Bitcoin’s quasi-political governance process.

Bitcoin’s economic features

- Fixed supply: one of the key parameters in the Bitcoin protocol is that the supply will expand over time to a final tally of 21 million coins. This fixed and known total supply, it is argued, makes Bitcoin a ‘hard asset,’ one of several characteristics that has contributed to its perceived value from an investment perspective.

-

- Hard asset – A hard asset is a tangible asset or resource with an underlying value. Examples of hard assets include fleets for the delivery of consumer goods, land, real estate, and commodities. Firms purchase hard assets to help improve production, increase revenues, and act as a buffer against soft asset losses. Sometimes, however, the value of hard assets declines along with the value of soft assets.

-

Other key parameters

- Disinflationary: the rate that new bitcoins are added to the circulating supply gradually decreases along a defined schedule that is built in to the code.Starting at 50 bitcoins per block (a new block is added approximately every 10 minutes), the issuance rate is cut in half approximately every four years. In May 2020, the third halving reduced the issuance rate from 12.5 to 6.25 bitcoins per block. At that point 18,375,000 of the 21 million coins (87.5% of the total) had been ‘mined.’ The fourth halving, in 2024, will reduce the issuance to 3.125 BTC, and so on until approximately the year 2136, when the final halving will decrease the block reward to just 0.00000168 BTC.

- Incentive driven: a core set of participants, known as miners, are driven by profit to contribute the resources needed to maintain and secure the network. Through a process known as Proof-of-Work (PoW), miners compete to add new blocks to the chain that constitutes the ledger (the blockchain). The hardware and energy costs associated with PoW mining contribute to the security of the network in a decentralized fashion along game-theory driven principles. The profit motive is considered important in this regard. Further, since miners tend to sell their earned bitcoin to cover their significant mining-related costs, the mining process is seen as a fair mechanism for widely distributing bitcoin.

What are the disadvantages of Bitcoin?

For all its advantages, Bitcoin does still pose some significant issues.

Perhaps one of the largest reasons everyone hasn’t jumped on the Bitcoin train is because its price is shrouded in uncertainty. Many people are concerned with…

Legal Gray Area. Major governments have largely remained on the sidelines, and this has created both a sense of potential and apprehension for Bitcoin proponents and critics respectively. Bitcoin isn’t backed by a regulatory agency and a government would technically be ceding power by supporting a decentralized currency. This has been largely officially unaddressed. Bitcoin’s price, however, tends to be very sensitive to any news concerning the US government’s opinion of cryptocurrencies. For example, when the SEC denied the approval of bitcoin-based exchange-traded-products—essentially bitcoin-backed assets on the stock market—in 2017, Bitcoin’s price dropped 18%. Yet while the price and adoption of Bitcoin would be affected by government action, governments are unable to criminalize Bitcoin. In fact, governments such as the United States and China have invested in it at some capacity.

Exchange hacks. As stated above, an exchange hack has nothing to do with the integrity of the Bitcoin system… but the market freaks out regardless. This trend seems to minimize as users see that cryptos recover from exchange hacks. As exchanges evolve and become more secure, this threat becomes less of an issue. Additionally, outside investments funneling into exchanges are providing the capital for them to grow stronger.

Illiquidity. It’s highly unlikely that Bitcoin’s price would plummet and you’d be unable to take action, but it’s still unsettling. As more investors invest, however, illiquidity becomes a negligible risk, as there will likely always be a buyer for Bitcoins waiting.

Nothing is perfect

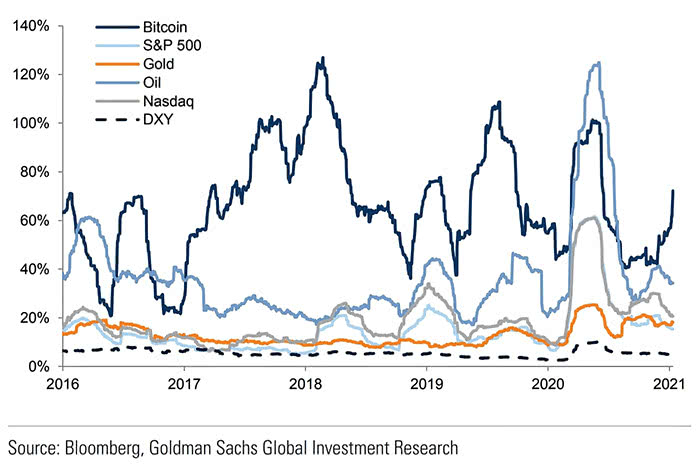

Volatility. This very reason many speculators are attracted to Bitcoin is the same reason many potential users are hesitant to get involved. Users that look at Bitcoin as a speculative investment option are essentially gambling on the process, and the future price of Bitcoin is largely unknown. There are estimates that Bitcoin will both be worth pennies in a few years, while some predict that a single bitcoin will be worth $500k in three years. As new investors continue to invest and the market cap grows, Bitcoin’s price could become more stable.

Lack of adoption by businesses. The price volatility is a large reason that many businesses have yet to adopt Bitcoin as a form of payment. Increased consumer adoption and price stability will eventually mitigate this disadvantage.

Another disadvantage is that while many people have heard of Bitcoin, few understand exactly what it is or how it functions. Guides like this help to push the needle and build a foundation, but it’s ultimately on the users to seek out more information.

Bitcoin’s strength lies in its networking effect. The more we spread the word and grow the Bitcoin community, the better off our bitcoins will be.

Final Thoughts

Bitcoin is still a relatively young currency but it has achieved substantial user adoption and growth. Bitcoin’s network only grows stronger as more people obtain a bitcoin ATM service to learn about Bitcoin’s fundamental technology and potential in relation to other methods of value storage.

As the flagship of the cryptocurrency fleet, Bitcoin is considered the “gateway” cryptocurrency. Understanding Bitcoin’s potential is an essential first step to seeing the brilliant solutions being worked on in the cryptocurrency world.

Bitcoin paints a future that is drastically different from the fiat-based world today. This is either exciting or unsettling for the vast majority. Equip yourself with the best possible resources. Become active in communities that further explore not only the technical applications of Bitcoin and other cryptos but with their overall potential to disrupt virtually every market. Brace yourselves. Cryptos are coming.