Ethereum is often referred to as the second most popular cryptocurrency, after Bitcoin. But unlike Bitcoin—and most other virtual currencies—Ethereum is intended to be much more than simply a medium of exchange or a store of value. Instead, Ethereum calls itself a decentralized computing network built on blockchain technology. Let’s unpack what that means.

What Is Ethereum?

Ethereum is a decentralized open-source blockchain system that features its own cryptocurrency, Ether. ETH works as a platform for numerous other cryptocurrencies, as well as for the execution of decentralized smart contracts.

Ethereum was first described in a 2013 whitepaper by Vitalik Buterin. Buterin, along with other co-founders, secured funding for the project in an online public crowd sale in the summer of 2014 and officially launched the blockchain on July 30, 2015.

Whitelist / Whitelist- is the list of enabled and identified individuals, cryptocurrency addresses, computer programs. In another way, it is connected with a piece of information, certain service, and event. Whitelists are defined as a separate way of the different contexts of their use. It is the best method to not let messages reaching spam folders. By following all crypto news, you will understand that in the context of cryptocurrency, it is an email address and assurance of upcoming emails coming to inbox.

Ethereum’s own purported goal is to become a global platform for decentralized applications, allowing users from all over the world to write and run software that is resistant to censorship, downtime and fraud.

How Does Ethereum Work?

Like all cryptocurrencies, Ethereum works on the basis of a blockchain network. A blockchain is a decentralized, distributed public ledger where all transactions are verified and recorded.

It’s distributed in the sense that everyone participating in the Ethereum network holds an identical copy of this ledger, letting them see all past transactions. It’s decentralized in that the network isn’t operated or managed by any centralized entity—instead, it’s managed by all of the distributed ledger holders.

Blockchain transactions use cryptography to keep the network secure and verify transactions. People use computers to “mine,” or solve complex mathematical equations that confirm each transaction on the network and add new blocks to the blockchain that is at the heart of the system. Participants are rewarded with cryptocurrency tokens. For the Ethereum system, these tokens are called Ether (ETH).

Ether can be used to buy and sell goods and services, like Bitcoin. It’s also seen rapid gains in price over recent years, making it a de-facto speculative investment. But what’s unique about Ethereum is that users can build applications that “run” on the blockchain like software “runs” on a computer. These applications can store and transfer personal data or handle complex financial transactions.

“Ethereum is different from Bitcoin in that the network can perform computations as part of the mining process,” says Ken Fromm, director of education and development at the Enterprise Ethereum Alliance.

“This basic computational capability turns a store of value and medium of exchange into a decentralized global computing engine and openly verifiable data store.”

Who Are the Founders of Ethereum?

Ethereum has a total of eight co-founders — an unusually large number for a crypto project. They first met on June 7, 2014, in Zug, Switzerland.

Russian-Canadian Vitalik Buterin is perhaps the best known of the bunch. He authored the original white paper that first described Ethereum in 2013 and still works on improving the platform to this day. Prior to ETH, Buterin co-founded and wrote for the Bitcoin Magazine news website.

British programmer Gavin Wood is arguably the second most important co-founder of ETH, as he coded the first technical implementation of Ethereum in the C++ programming language, proposed Ethereum’s native programming language Solidity and was the first chief technology officer of the Ethereum Foundation. Before Ethereum, Wood was a research scientist at Microsoft. Afterward, he moved on to establish the Web3 Foundation.

Among the other co-founders of Ethereum are:

- Anthony Di Iorio, who underwrote the project during its early stage of development. –

- Charles Hoskinson, who played the principal role in establishing the Swiss-based Ethereum Foundation and its legal framework. –

- Mihai Alisie, who provided assistance in establishing the Ethereum Foundation. –

- Joseph Lubin, a Canadian entrepreneur, who, like Di Iorio, has helped fund Ethereum during its early days, and later founded an incubator for startups based on ETH called ConsenSys. –

- Amir Chetrit, who helped co-found Ethereum but stepped away from it early into the development.

Blockchain and Ethereum architecture

Blockchain and Ethereum architecture

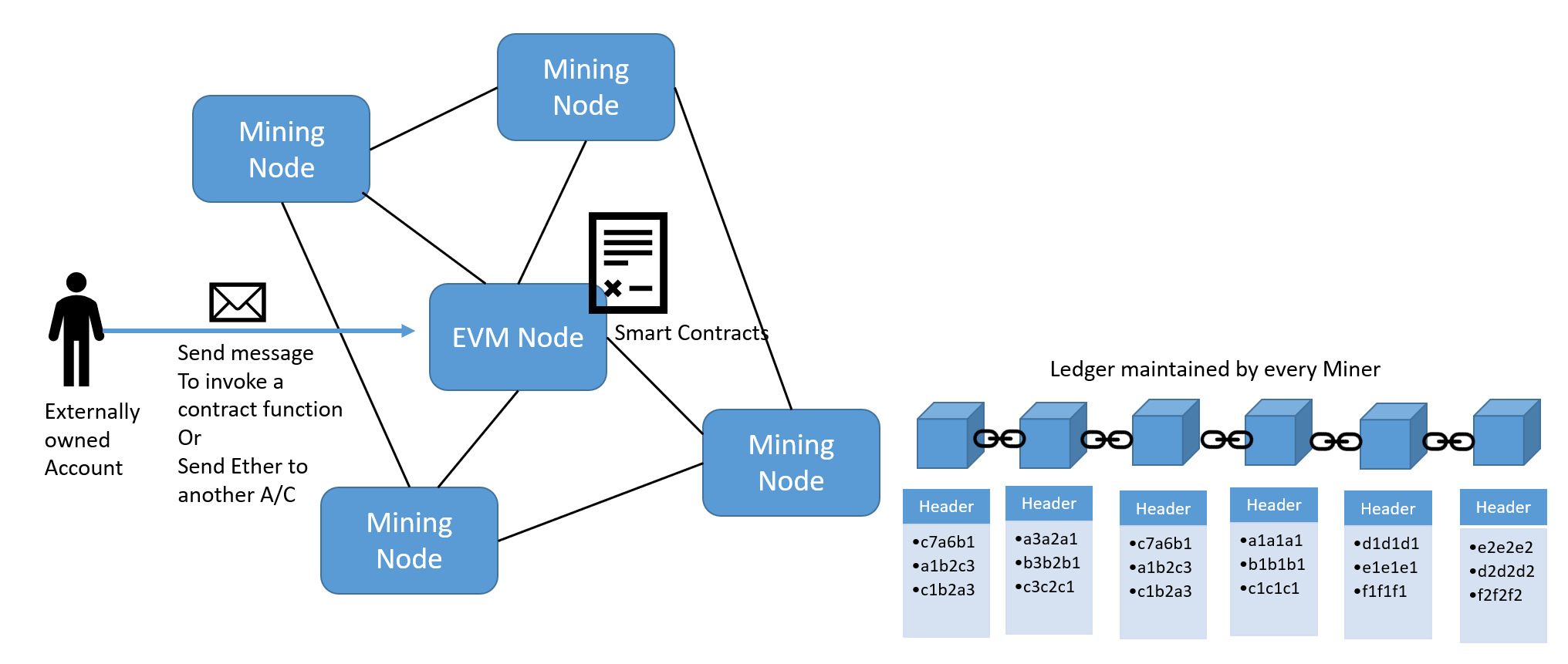

Blockchain is an architecture comprising multiple components and what makes blockchain unique is the way these components function and interact with each other. Some of the important Ethereum components are Ethereum Virtual Machine (EVM), miner, block, transaction, consensus algorithm, account, smart contract, mining, Ether, and gas. We are going to discuss each of these components in this chapter.

A blockchain network consists of multiple nodes belonging to miners and some nodes that do not mine but help in execution of smart contracts and transactions. These are known as EVMs. Each node is connected to another node on the network. These nodes use peer-to-peer protocol to talk to each other. They, by default, use port 30303 to talk among themselves.

Each miner maintains an instance of ledger. A ledger contains all blocks in the chain. With multiple miners it is quite possible that each miner’s ledger instance might have different blocks to another. The miners synchronize their blocks on an on-going basis to ensure that every miner’s ledger instance is the same as the other.

Details about ledgers, blocks, and transactions are discussed in detail in subsequent sections in this chapter.

The EVM also hosts smart contracts. Smart contracts help in extending Ethereum by writing custom business functionality into it. These smart contracts can be executed as part of a transaction and it follows the process of mining as discussed earlier.

A person having an account on a network can send a message for transfer of Ether from their account to another or can send a message to invoke a function within a contract. Ethereum does not distinguish them as far as transactions are considered. The transaction must be digitally signed with an account holder’s private key. This is to ensure that the identity of the sender can be established while verifying the transaction and changing the balances of multiple accounts. Let’s take a look at the components of Ethereum in the following diagram:

How are blocks related to each other?

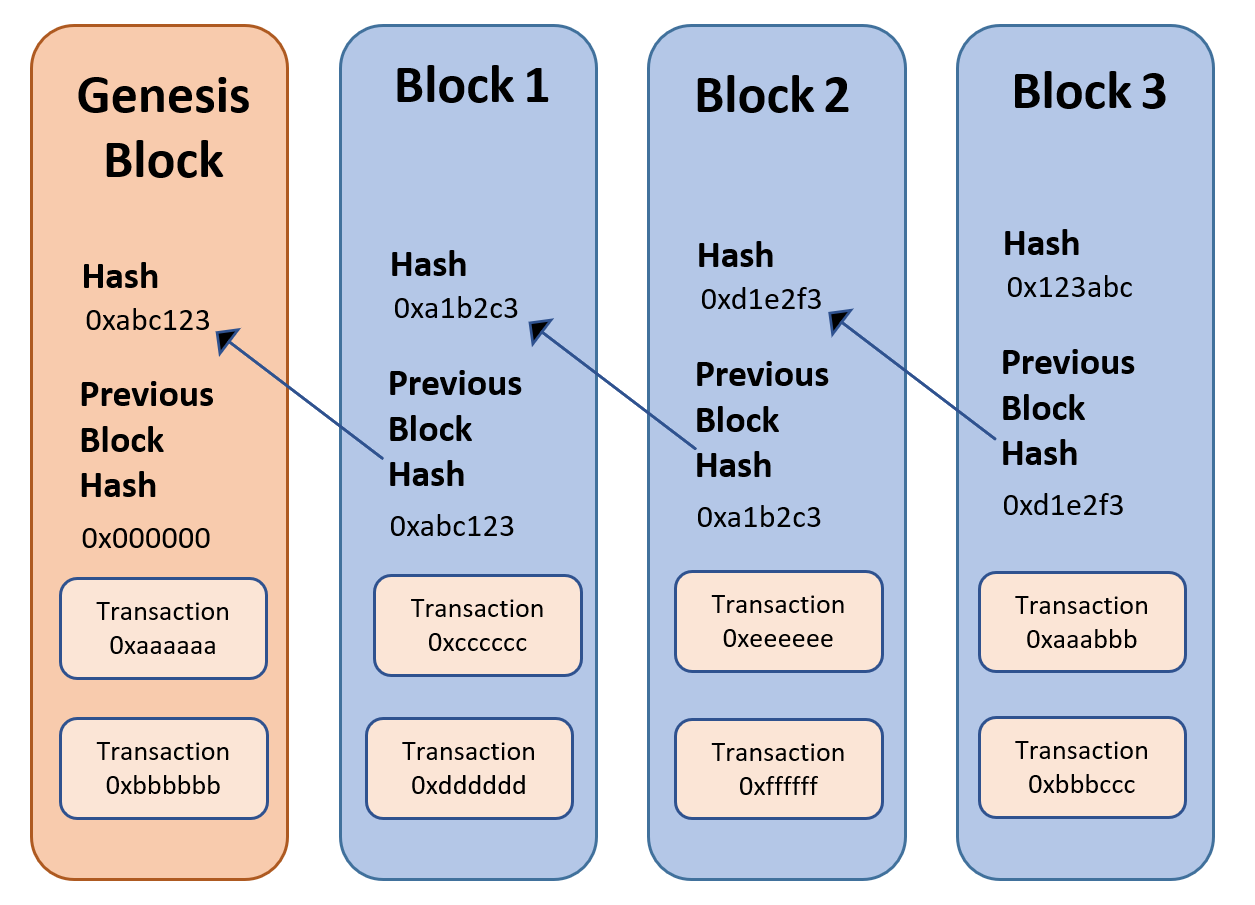

In blockchain and Ethereum every block is related to another block. There is a parent-child relationship between two blocks. There can be only one child to a parent and a child can have a single parent. This helps in forming a chain in blockchain. Blocks are explained in a later section in this chapter. In the following diagram, three blocks are shown—Block 1, Block 2, and Block 3. Block 1 is the parent of Block 2 and Block 2 is the parent of Block 3. The relationship is established by storing the parent block’s hash in a child’s block header. Block 2 stores the hash of Block 1 in its header and Block 3 stored the hash of Block 2 in its header. So, the question arises—who is the parent of the first block? Ethereum has a concept of the genesis block also known as first block. This block is created automatically when the chain is first initiated. You can say that a chain is initiated with the first block known as the Genesis Block and the formation of this block is driven through the genesis.json file. Let’s take a look at the following diagram:

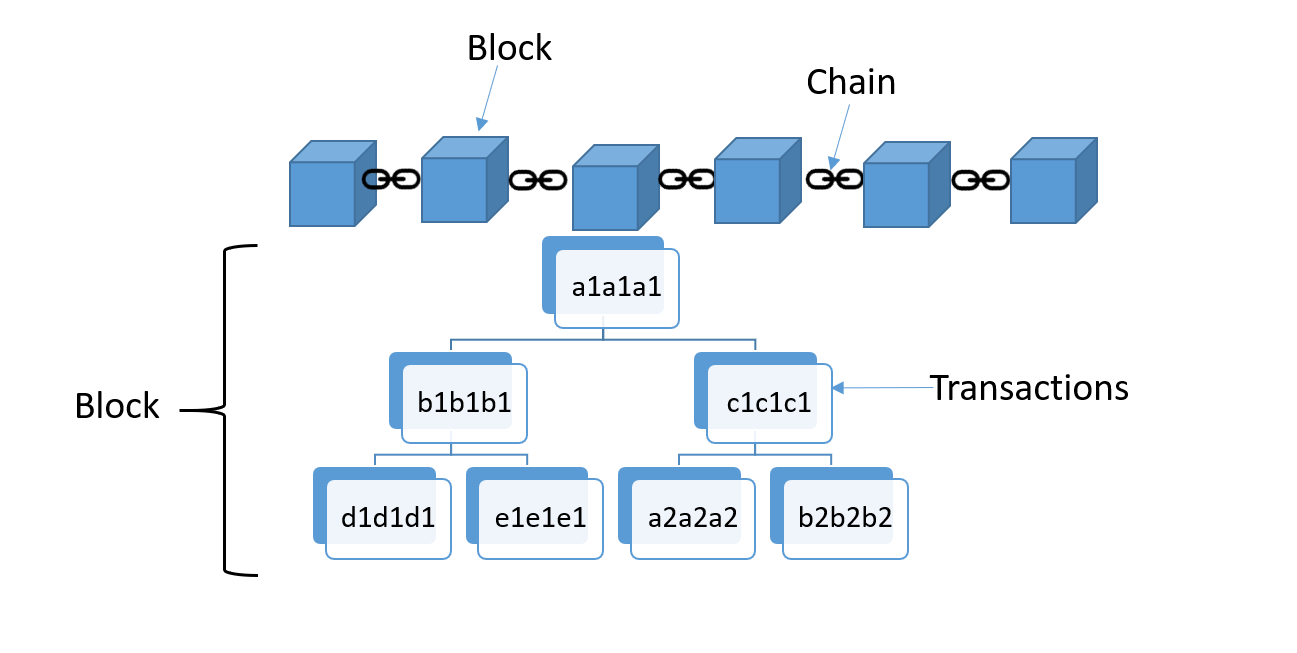

How are transactions and blocks related to each other?

Now that we know that blocks are related to each other, you will be interested in knowing how transactions are related to blocks. Ethereum stores transactions within blocks. Each block has an upper gas limit and each transaction needs a certain amount of gas to be consumed as part of its execution. The cumulative gas from all transactions that are not yet written in a ledger cannot surpass the block gas limit. This ensures that all transactions do not get stored within a single block. As soon as the gas limit is reached, other transactions are removed from the block and mining begins thereafter.

The transactions are hashed and stored in the block. The hashes of two transactions are taken and hashed further to generate another hash. This process eventually provides a single hash from all transactions stored within the block. This hash is known as the transaction Merkle root hash and is stored in a block’s header. A change in any transaction will result in a change in its hash and, eventually, a change in the root transaction hash. It will have a cumulative effect because the hash of the block will change, and the child block has to change its hash because it stores its parent hash. This helps in making transactions immutable. This is also shown in the following diagram:

Ether and Ethereum: What’s the Difference?

You can use Ether as a digital currency in financial transactions, as an investment or as a store of value. Ethereum is the blockchain network on which Ether is held and exchanged. As mentioned above, however, this network offers a variety of other functions outside of ETH.

“These can be simple movements of funds, but they may also be complex transactions that do anything from exchanging assets to taking out loans to acquiring a piece of digital art,”

says Boaz Avital, head of product at Anchorage. The transactions are processed and stored on the Ethereum network.

The Ethereum network can also be used to store data and run decentralized applications. Rather than hosting software on a server owned and operated by Google or Amazon, where the one company controls the data, people can host applications on the Ethereum blockchain. This gives users control over their data and they have open use of the app as there’s no central authority managing everything.

Perhaps one of the most intriguing use cases involving Ether and Ethereum are self-executing contracts, or so-called smart contracts. Like any other contract, two parties make an agreement about the delivery of goods or services in the future. Unlike conventional contracts, lawyers aren’t necessary: The parties code the contract on the Ethereum blockchain, and once the conditions of the contract are met, it self-executes and delivers Ether to the appropriate party.

What Makes Ethereum Unique?

Ethereum’s principal innovation was designing a platform that allowed it to execute smart contracts using the blockchain, which further reinforces the already existing benefits of smart contract technology. Ethereum’s blockchain was designed, according to co-founder Gavin Wood, as a sort of “one computer for the entire planet,” theoretically able to make any program more robust, censorship-resistant and less prone to fraud by running it on a globally distributed network of public nodes.

In addition to smart contracts, Ethereum’s blockchain is able to host other cryptocurrencies, called “tokens,” through the use of its ERC-20 compatibility standard. In fact, this has been the most common use for the ETH platform so far: to date, more than 280,000 ERC-20-compliant tokens have been launched. Over 40 of these make the top-100 cryptocurrencies by market capitalization, for example, USDT, LINK and BNB.

How Is the Ethereum Network Secured?

As of August 2020, Ethereum is secured via the Ethash proof-of-work algorithm, belonging to the Keccak family of hash functions.

There are plans, however, to transition the network to a proof-of-stake algorithm tied to the major Ethereum 2.0 update, which launched in late 2020.

Ethereum vs Bitcoin

Bitcoin’s primary use is as a virtual currency and store of value. Ether also works as a virtual currency and store of value, but the decentralized Ethereum network makes it possible to create and run applications, smart contracts and other transactions on the network. Bitcoin doesn’t offer these functions. It’s only used as a currency and store of value.

Ethereum also processes transactions more quickly. “New blocks are validated on the Bitcoin network once every 10 minutes while new blocks are validated on the Ethereum network once every 12 seconds,” says Gary DeWaal, chair of Katten’s Financial Markets and Regulation group. And future developments could speed up Ethereum transactions even more, he notes.

Last, there is no limit on the number of potential Ether tokens while Bitcoin will release no more than 21 million coins.

Ethereum Benefits

- Large, existing network. “The benefits of Ethereum are a tried-and-true network that has been tested through years of operation and billions of value trading hands,” says Fromm. “It has a large and committed global community and the largest ecosystem in blockchain and cryptocurrency.”

- Wide range of functions. Besides being used as a digital currency, Ethereum can also be used to process other types of financial transactions, execute smart contracts and store data for third-party applications.

- Constant innovation. A large community ot Ethereum developers is constantly looking for new ways to improve the network and develop new applications. “Because of Ethereum’s popularity, it tends to be the preferred blockchain network for new and exciting (and sometimes risky) decentralized applications,” says Avital.

- Avoids intermediaries. Ethereum’s decentralized network promises to let users leave behind third-party intermediaries, like lawyers who write and interpret contracts, banks that are intermediaries in financial transactions or third-party web hosting services.

Ethereum Disadvantages

- Rising transaction costs. Ethereum’s growing popularity has led to higher transaction costs. Ethereum transaction fees, also known as “gas,” hit a record $23 per transaction in February 2021, which is great if you’re earning money as a miner but less so if you’re trying to use the network. This is because unlike Bitcoin, where the network itself rewards transaction verifiers, Ethereum requires those participating in the transaction to cover the fee.

- Potential for crypto inflation. While Ethereum has an annual limit of releasing 18 million Ether per year, there’s no lifetime limit on the potential number of coins. This could mean that as an investment, Ethereum might function more like dollars and may not appreciate as much as Bitcoin, which has a strict lifetime limit on the number of coins.

- Steep learning curve for developers. Ethereum can be difficult for developers to pick up as they migrate from centralized processing to decentralized networks.

- Unknown future. Ethereum continues to evolve and improve, and the ongoing development of Ethereum 2.0 holds out the promise of new functions and greater efficiency. This major update to the network, however, is creating uncertainty for apps and deals currently in use. “Many new validators will be required for Ethereum 2.0 to function,” says DeWaal. “The question is will the migration work? There are a lot of new elements that have to fall into place!”

How to Buy Ethereum

It’s a common misconception to people who are new to the Ethereum network. You don’t buy Ethereum itself—that’s the network. Instead, you buy Ether and then use it on the Ethereum network. Given Ethereum’s popularity, it’s very easy to buy Ether:

- Pick a cryptocurrency exchange. Crypto exchanges and trading platforms are used to buy and sell different cryptocurrencies. Coinbase, Binance and Kraken are a few of the larger exchanges. If you are just interested in purchasing the most common coins like Ether and Bitcoin, you could also use an online brokeragelike Robinhood or SoFi. Be prepared to pay some amount of trading or processing fees almost universally.

- Deposit fiat money. You’ll need to deposit cash, like dollars, in your trading platform or link your bank account or debit card to fund purchases of Ether.

- Buy Ether. Once you’ve funded your account, you can use the money to purchase Ether at the current Ethereum price along with other assets. Once the coins are in your account, you could hold them, sell them or trade them for other cryptocurrencies in the future. Keep in mind you may incur taxes whenever you sell or trade cryptocurrencies.

Recommendation to conclude

Use a wallet. While you could store the Ether in your trading platform’s default digital wallet, this can be a security risk. If someone hacks the exchange, they could easily steal your coins. Another option is to transfer coins you aren’t planning on selling or trading soon into another digital wallet or a cold wallet that’s not connected to the internet for safety.

Before making any significant investment in Ether or other cryptocurrencies, consider speaking with a financial advisor first about the potential risks. Given the high risk and volatility in this market, make sure it’s money you can afford to lose, even if you believe in Ethereum’s potential.